How to Apply for the National Bank Syncro Mastercard Credit Card

The National Bank Syncro Mastercard offers a competitive low interest rate, flexible payment options, and purchase protection with an extended warranty. Enjoy added value with affordable annual fees and comprehensive travel and medical insurance, making it a smart choice for both daily spending and international travel.

How to Apply for National Bank World Elite Mastercard Credit Card

The National Bank World Elite Mastercard offers rewarding points on everyday purchases, comprehensive travel insurance, and global airport lounge access. Enjoy 24/7 concierge services and save on international use with no foreign transaction fees, making it an ideal choice for frequent travelers and daily spenders.

How to Apply for the NEO Credit Card Quick Easy Steps

The NEO Credit Card offers enticing benefits for savvy spenders: earn cash back on all purchases, enjoy no annual fees, and benefit from flexible payment options. Widely accepted across Canada, it maximizes rewards, especially with exclusive deals, making it a smart choice for everyday savings.

How to Apply for the AMEX Business Platinum Card from American Express

Unlock a world of rewards with the AMEX Business Platinum Card. Earn 1.25 points per dollar on purchases and enjoy exclusive airport lounge access. Benefit from a $200 CAD annual travel credit, tailored business discounts, and comprehensive travel insurance for peace of mind on your business journey.

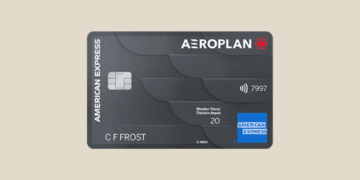

How to Apply for AMEX American Express Aeroplan Card Easily

Earn Aeroplan points on every purchase with the AMEX American Express Aeroplan Card, redeemable for flights. Enjoy no foreign transaction fees, comprehensive travel insurance, and exclusive airport lounge access, enhancing your travel experience. Maximize rewards by using the card for everyday expenses and international purchases.

How to Apply for the National Bank Platinum Mastercard Credit Card

Uncover the advantages of the National Bank Platinum Mastercard Credit Card: enjoy comprehensive insurance coverage, earn reward points on everyday purchases, and benefit from complimentary roadside assistance. Additionally, take advantage of flexible payment plans and 24/7 concierge service for a seamless, stress-free lifestyle.

Risk Assessment in Infrastructure Projects: Analyzing Financial Viability and Social Impacts

Effective risk assessment is crucial for infrastructure projects, balancing financial viability with social impacts. By identifying potential financial pitfalls and addressing community concerns, stakeholders can ensure sustainable development that fosters trust and enhances quality of life. A holistic approach is vital for successful outcomes in infrastructure initiatives.

Risk Assessment in Startups: Methods for Investors to Evaluate Growth Potential

Investors in startups can mitigate risks and enhance returns through effective risk assessment methods. By evaluating market demand, management capabilities, financial health, and competitive landscape, they can make informed decisions. Employing qualitative and quantitative frameworks like SWOT analysis and financial modeling is crucial for identifying promising growth potential in early-stage ventures.

Risk Assessment in the Insurance Industry: How to Determine Fair Premiums

Risk assessment is crucial in the insurance industry for determining fair premiums. Insurers evaluate diverse factors, including client data, market trends, and regulatory compliance, to establish pricing that reflects individual risk profiles. Emerging technologies, like big data and AI, enhance these methodologies, ensuring transparency and competitiveness in premium calculations.

The Importance of Risk Assessment in Investments: Strategies to Protect Your Capital

Effective risk assessment in investments is crucial for safeguarding capital and achieving financial goals. By understanding market volatility, economic conditions, and regulatory changes, investors can adopt strategies like diversification, regular monitoring, and stop-loss orders to manage risks. Proactive risk management enhances confidence and fosters sustainable growth in the competitive investment landscape.